|

|

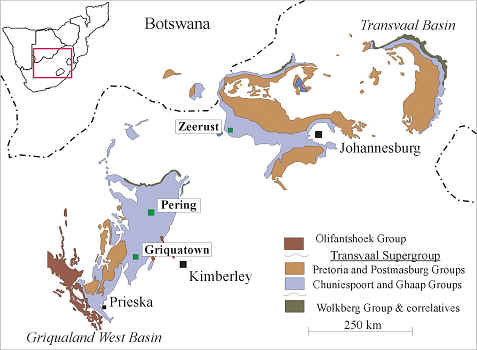

Geological sketch map illustrating the distribution of carbonate-hosted

Zn-Pb and F deposits

in the dolostones of the Transvaal Supergroup.

![]()

WITKOP FLUORSPAR MINE EXPANSION

At the end of June an R11 million (US$1.8 million) plant upgrade at Sallies’

Witkop fluorspar mine located just south of Zeerust in South Africa was

near completion and this will see its production increase from 100,000

tonnes to 180,000 tonnes a year.

Sallies, a Johannesburg Stock Exchange listed company for 100 years, with

the Witkop fluorspar mine as its main asset, ran into difficulties during

2003. This was attributed to a combination of factors including an inefficient

head office management structure coupled with high head office costs.

The operation, which employs 200 people, suffered from plant breakdowns

due to poor maintenance as a result of a lack of funding and this led

to fluctuating plant efficiencies. This was exacerbated by irregular power

supply and the end result was a varying product quality and a decrease

in acid grade fluorspar volumes. This together with the strengthening

rand and deterioration in head grade saw the operation making losses.

As a result the turn around specialist FMR was appointed in February 2003,

for three years, to implement a programme to return the company and the

mine to profitability. The key of the turn around strategy involves the

mine increasing output at a lower unit cost. At the start of 2004 Sallies

raised R36 million (US$6.5 million) through a rights offer and some of

this funding was allocated to expand and upgrade the Witkop plant.

One of the Wintershoek open pits at Witkop.

Witkop is a low grade fluorspar operation that was selectively mined by Phelps Dodge, its previous owner until 1999, but with these areas having been depleted the mine now has to mine ore at an average lower grade. Sallies plans to operate the mine at a head grade of 12% using a more steady resource management basis than was previously done. To offset these lower grades, a new ball mill, Number 3 mill, was commissioned in April, and Number 4 mill as well as the Number 6 regrind mill were commissioned in June 2004 to increase tonnage throughput by the Witkop plant.

A blast at the Witkop fluorspar mine

The operation

has two open pit ore bodies, Wintershoek, mined from about three open

pits, and Buffelshoek. A blend from the two ore bodies is optimal for

the plant throughput and recoveries. Wintershoek has proven reserves of

17.8 million tonnes at a grade of 14.3% CaF2 (fluorspar), while Buffelshoek

has a reserve of 9.5 million tonnes at a grade of 18.6% CaF2. The Wintershoek

ore body is the one currently being predominantly mined and at a production

rate of 180,000 tonnes a year it will have a life of mine of another eight

years.

The Witkop operation involves drilling, blasting, loading and haulage

using Cat and Bell equipment, followed by the blending of the ore from

the two different ore bodies, and a crushing stage involved primary, secondary

and tertiary crushing. This is followed by milling and classification,

a pre-float and thickening stage, and a rougher stage where the concentration

of CaF2 is upgraded to 30%. There are several cleaner stages which increasingly

upgrade the percentage of CaF2 content. The operation also makes use of

a regrind mills and the final product contains 97% CaF2 with only 2% manganese

and copper and 1% silica and iron. After filtration to dry it, the product

is transported via the Lucerne station where it is loaded on 54 tonne

rail cars. Fluorspar for the local market is sold in 25 kg bags, or in

bulk.

THE FLUORSPAR MARKET

The mine produces both acid grade (greater than 97% purity) and metallurgical

grade (less than 97% purity) fluorspar. Metallurgical grade fluorspar

is used as a fluxing agent in the manufacture of steel, stainless steel,

cement, ceramics and glass, and the mine supplies customers such as Iscor,

PPC, Highveld Steel and Consol Glass. The acid grade fluorspar is used

in combination with sulphuric acid to form hydrogen fluoride (HF), and

with sulphuric acid and aluminium hydrate to form aluminium fluoride (AlF3).

Hydrogen fluoride is further processed into refrigerant gases, HCFC –

which is an interim replacement for ozone unfriendly CFCs – and HFC,

which will phase out HCFC over time, and which coincidently uses twice

as much acid grade fluorspar. The market for aluminium fluoride is also

a promising one in that it is further processed into downstream aluminium

products, one of the faster growing world markets.

Like many other commodities fluorspar benefits from China’s ongoing

rapid modernisation. The production of fluorspar is dominated by China,

which produced 54% of world output in 2002, followed by Mexico at 14%,

while Europe and Russia account for another 13%. In 2000 Chinese exports

were two million tonnes of fluorspar, but this dropped to 750,000 tonnes

in 2003 as the country’s internal consumption increased. It is estimated

that Chinese exports will decrease further in 2004 to 420,000 tonnes.

Sallies chief executive Lindsay Robertson predicts that by 2010 China

will not be exporting fluorspar, which leaves a gap to fill and he says

that Sallies wants to be one of the companies that fills it.

One of the new mills installed at Witkop to increase throughput.

South Africa accounts for about 5% of world fluorspar production, with

the country’s main producers being Witkop and the Vergenoeg operation,

owned by Metorex, which produces about 100,000 tonnes a year and which

is also looking at a possible increase in production. There is also the

Buffalo fluorspar recycling operation that is capable of producing some

10,000 tonnes a year and this could increase with investment in plant.

Witkop’s production averaged 100,000 tonnes a year between 1998 and

2003, and once the expansion/upgrade is complete, the operation that works

24 hours a day every day of the year, will produce 550 t/day of fluorspar

and on good days it could up this to 600 t/day. At the end of July it

will be producing at a level of least 450 t/day.

“Although South Africa is a relatively small producer, a mine such

as Witkop has advantages in terms of the quality of product compared with

others that makes the fluorspar it produces a desirable product,”

Robertson says. “For example, Mexico’s fluorspar is high in

arsenic content, an undesirable contaminant, whereas the South African

fluorspar can trade at a premium because of an almost zero arsenic content.

Another example is that in comparison to Kenya’s fluorspar, which

is high in P2O5 and is unsuited for aluminium production, South African

fluorspar is low in P2O5.”

One of the problems faced by Witkop is that with production running as

low as 60,000 tonnes a year at one stage before its turnaround began,

it has fallen behind on a five-year contract with its main customer Honeywell

in the US. It is a five-year contract begun in 2001 that requires the

mine to provide 85,000 tonnes a year of acid grade fluorspar. In June

2004 this contract was six months behind schedule, with some 170,000 tonnes

still to be delivered before the end of 2005, and the mine’s increased

output will go towards meeting this obligation. Robertson says that unfortunately

the mine negotiated this contract as one where Honeywell dictates the

price paid for the fluorspar based on the average price it receives from

its other suppliers, and this has seen Honeywell paying US$100/t compared

with a spot price of US$135/t. The spot market for fluorspar is small,

mainly a result of shortfalls due to suppliers unable to meet their contractual

tonnages, as was the case with Sallies in its recent past. Robertson says

that any future contracts will be negotiated differently, and that even

under the current contract the price paid by Honeywell will go up to a

minimum of US$110/tonne, with fluorspar prices having increased. In addition

to meeting these contractual obligations, Sallies has arranged to supply

four different customers in Europe, the most important being Bayer, with

prices being paid not less than US$130/t. In total the company expects

to get an average sales price per tonne of US$120 for its next financial

year. Robertson says that the company is looking at prices better than

US$140/t in 2005.

Flotation circuit at the Witkop plant.

These prices will make the mine profitable at a rand/dollar price of 6.5:1, but the company has a contingency plan should the rand remain at a higher level. This involves the recycling of tailings, where a drilling programme has been completed and a 50 t/h pilot plant was running at the end of June 2004. A full tailings recycling project could be underway by the end of March 2005 and one of the tailings dumps containing up to 6% fluorspar, Dump 1, has sufficient material to provide the plant with 500 tonnes a day for ten months. In all Witkop has an estimated 45 million tonnes of tailings material that could be considered for recycling. The pilot plant produces a slurry of 20% CaF2, which is then added into the processing circuit. It is not envisaged that the mine would cease operating altogether and rely completely on dump tailings processing, even under strong rand conditions.

The pilot plant for the recovery of tailings at Witkop.

THE TURNAROUND

The initial

turnaround strategy implemented by FRM involved a corporate restructure

that saw Sallies’ Johannesburg head-office closed down. Negotiations

with Eskom also saw the consistency of power supply restored, and this

together with the company’s focus on maintenance has improved plant

availability. The new management also visited major customers, such as

Honeywell, whose plant is suited to the Witkop product, to cement the

continuing long-term relationship. The aim is to supply 50% of the bulk

of the mine’s output to Honeywell, and the other 50% to Europe and

the Far East. Some 10,000 to 20,000 tonnes may be reserved to take advantage

of the small spot market.

FRM has decreased the mining cost per tonne from R25/t (US$4/t) to R15/t

(US$2.50/t). This was done by converting from contractor to owner mining,

which began in October 2003, thanks to financing from WesBank that enabled

the purchase of new equipment. That means the total processing cost of

the final product is about R200 – 250/t (US$33 – 41/t), to which

is added rail costs from Zeerust to Durban and Durban Bulk Terminal costs

that together total about R300/t (US$50/t). The FOB break even cost for

the Witkop mine is thus about or below R700/t (US$115/t).

The Witkop property covers 8,000 ha, of which 312 ha is used for mining,

and the operation will need to determine where it will mine in the future,

and make a decision on portions of the property which do not contain any

such resources. Sallies is also disposing of its East Rand mineral and

property rights to focus on its Witkop fluorspar operation.

Texte issu de :

http://www.miningreview.com/archive/mra_4_2004/42_1.php

![]()

http://www.miningweekly.co.za/article.php?a_id=99355

Fluorspar

Related articles

Some workers down tools at Sallies' Witkop mine

Fluorspar producer Sallies said on Thursday that its wage payroll workers

at the Witkop mine have downed tools on Wednesday night over pay demands.

Witkop miners return to work

The 200 workers that had been locked out at fluorspar miner Sallies? Witkop

mine, near Zeerust, last week were back at work, the company said on...

Witkop Fluorspar mine, North West Province

Sallies workers end two-day strike

Fluorspar miner renews efforts to end strike

By: Carla Fernandes

Published: 19 Jan 07 - 0:00

Name:

Witkop Fluorspar Mine.

Location:

Witkop mine is located 18 km south of Zeerust in the Marico district,

North West province.

Brief

history: Sallies was incorporated in 1903 as the South African Land and

Exploration Mining Company Limited and has been listed since 1904 in the

mining sector of what is now JSE Limited. On July 1, 1999, the company

acquired a 100% interest in Witkop Fluorspar Mine (Proprietary) Limited

and its wholly-owned subsidiary, Marico Fluorspar (Proprietary) Limited

for R80-million. Following its acquisition of the Witkop mine in the North

West province of South Africa in 1999, the company changed its name to

Sallies Limited.

Brief

description: Witkop has an estimated mine life of 12 to 15 years and employs

250 people.

Products:

Fluorspar.

Mining

method: Opencast.

Reserves:

Total proven reserves as at June 30, 2006, are 26,3-million tons.

Resources:

Unstated.

Geology:

The Witkop fluorspar mineral deposit lies within the Marico Fluorspar

Field, an area of expansive outcropping and subcropping of low- to medium-grade

fluorspar in dolomite. The bulk of the fluorspar mineralisation occurs

as a number of discontinuous zones in the Frisco Formation of the Malmani

Subgroup of the Transvaal Sequence. The predominant host rock for most

of the ore is a grey, medium-grained, sparry dolomite.

Major infrastructure and equipment: Spread over nearly 7 000 ha of surface

rights, with new-order mining rights, Witkop mine uses a fleet of Bell

30-t ADTs and Bell excavators with Komatsu loaders.

Prospects: The mine is engaged in a project to recycle some of its tailing

dams in order to significantly increase its mine life. Further exploration

drilling may be undertaken to increase reserves.

Controlling company: Sallies Ltd (100%).

Contact

person: Helen McKane, investor and media relations.

Unique features: Use of the lowest grade fluorspar deposit in the world.

Contact

details:

Sallies Ltd.

Tel: +27 18 642 8440 Fax: +27 18 642 8426 Website: www. sallies.co.za

![]()

WITKOP

FLUORSPAR MINE

Witkop Fluorspar Mine, an opencast fluorspar mine is situated near Zeerust

in Northwest Province.

The opencast mining and rehabilitation contract was executed from 2001

to 2004.